Financial Statement Modelling Part I Introduction

6 Introduction To Financial Modelling | PDF

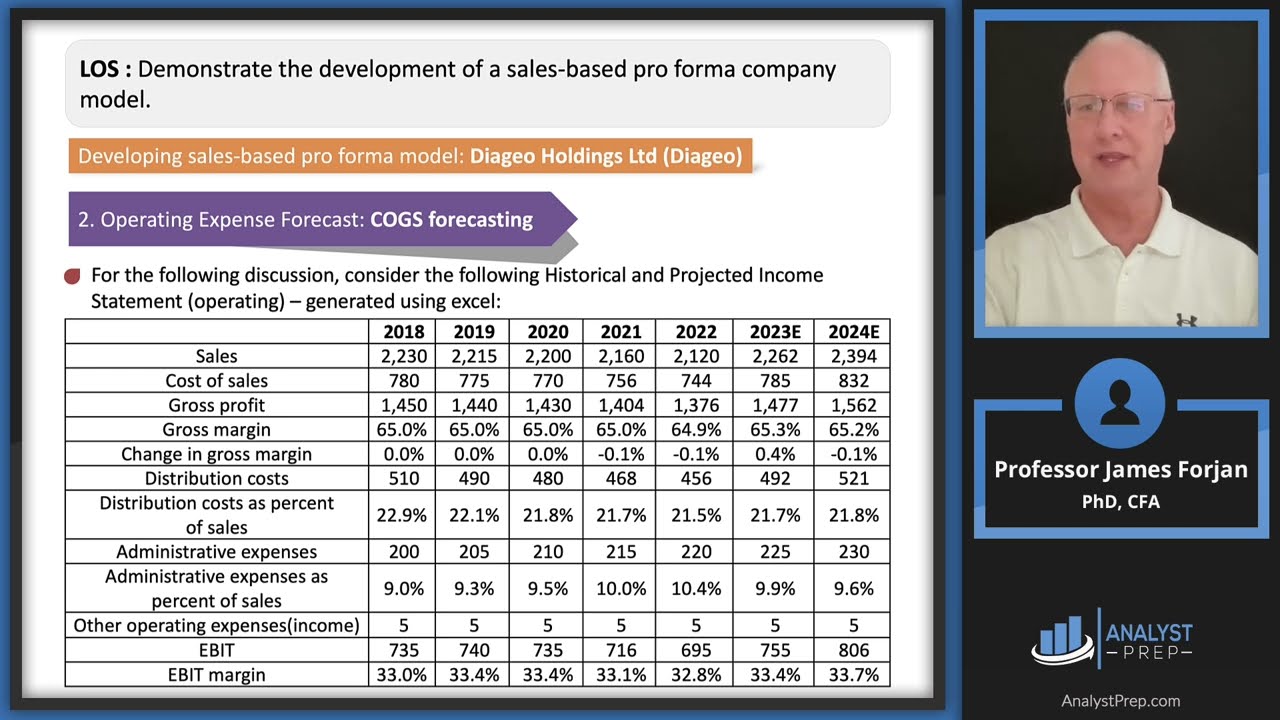

6 Introduction To Financial Modelling | PDF Los : demonstrate the development of a sales based pro forma company model. los : explain how behavioral factors affect analyst forecasts and recommend remedial actions for analyst biases. Master the essentials of financial statement modeling with a focus on building, interpreting, and projecting financial statements for informed analysis.

Module 1 Introduction To Accounting 1 | PDF | Financial Statement | Business

Module 1 Introduction To Accounting 1 | PDF | Financial Statement | Business Financial statement modeling is a key step in the process of valuing companies and the securities they have issued. an effective financial statement model must be based on a thorough. Dive deep into long term financial forecasting essentials, from selecting the perfect forecast horizon to grappling with the concept of terminal value. learn how to make forecasts that span several years, ensuring your financial analysis remains robust over time. We then describe the general approach to forecasting each of the financial statements and demonstrate the construction of a financial statement model, including forecasted income statements, balance sheets, and statements of cash flows. Learn how to develop sales based pro forma company models in this comprehensive video lesson for the 2025 cfa® level i exam financial statement analysis section.

Financial Statement Modeling Training For Financial Analysts PPT Slide

Financial Statement Modeling Training For Financial Analysts PPT Slide We then describe the general approach to forecasting each of the financial statements and demonstrate the construction of a financial statement model, including forecasted income statements, balance sheets, and statements of cash flows. Learn how to develop sales based pro forma company models in this comprehensive video lesson for the 2025 cfa® level i exam financial statement analysis section. A financial statement model is the starting point for most valuation models, and valuation estimates can be made based on a variety of metrics, including free cash flow, eps, ebitda, and ebit. Financial modeling lets you quantify your views of a company and back up your arguments with actual numbers. here are a few examples of how you might use it: • stock investing: a pharmaceutical company’s stock price just fell by 50%. was that decline justified, or did the market overreact?. Part i of the course concludes with us building a dynamic financial model that forecasts eps and the financial statements and their supporting schedules for a publicly listed company. Provide detailed information on how to construct integrated financial statements. see how key commercial and financial concepts can be translated into excel. help participants understand the sequence and steps for building a financial model from scratch.

Introduction to Financial Statement Modeling (2025 CFA® Level I Exam – FSA – Learning Module 12)

Introduction to Financial Statement Modeling (2025 CFA® Level I Exam – FSA – Learning Module 12)

Related image with financial statement modelling part i introduction

Related image with financial statement modelling part i introduction

About "Financial Statement Modelling Part I Introduction"

Comments are closed.