Financial Modeling Versus Forecasting Whats The Difference Now Cfo

Overview Of Financial Modeling And Forecasting | Download Free PDF | Forecasting | Statistics

Overview Of Financial Modeling And Forecasting | Download Free PDF | Forecasting | Statistics Financial modeling entails gathering information from data, reports, and forecasts to simulate various economic and business scenarios. this allows the company to evaluate the impact that these scenarios would have on the business both in the short and long term. Financial modeling is the process through which a company builds its financial representation and is used to make business decisions. financial models use forecasts to analyze how different scenarios may play out and impact the company’s performance.

Financial Modeling Versus Forecasting—What’s The Difference? - NOW CFO

Financial Modeling Versus Forecasting—What’s The Difference? - NOW CFO Financial forecasting and financial modeling are closely related, but they serve different purposes in corporate finance. a forecast uses historical data, market trends, and business drivers to predict a company’s financial performance, such as revenue, expenses, and cash flow, over a future period. Financial forecasting is the process of projecting how a business will perform during a future reporting period. financial modeling is the process of gathering information from forecasts and other data, then simulating discrete scenarios to analyze what impact they might have on the company’s financial health. Through this article, we focus on financial modeling vs financial forecasting differences to better understand both. a common and repeated misconception is that financial modeling and financial forecasting are the same. At now cfo, we provide expert financial modeling and cash flow forecasting designed to meet your business’s unique needs. our team of outsourced financial consultants and accountants brings years of experience to help you manage your financial landscape.

Useful Financial Forecasting Methods - Techniques Every CFO Must Know

Useful Financial Forecasting Methods - Techniques Every CFO Must Know Through this article, we focus on financial modeling vs financial forecasting differences to better understand both. a common and repeated misconception is that financial modeling and financial forecasting are the same. At now cfo, we provide expert financial modeling and cash flow forecasting designed to meet your business’s unique needs. our team of outsourced financial consultants and accountants brings years of experience to help you manage your financial landscape. Financial forecasting vs. financial modeling: the hidden differences experts want you to know the covid 19 pandemic forced businesses worldwide to rebuild their financial forecasting models from scratch. the economic upheaval revealed something significant: knowing the difference between financial forecasting and financial modeling could determine a company’s survival through smart decisions. Financial forecasting and modeling are the backbone of business decision making. the correct forecast can be the difference between making a strategic leap forward and tumbling into deep operational pitfalls. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results. a financial model is simply a spreadsheet, usually built in microsoft excel, that forecasts a business’s financial performance into the future. Financial modeling and forecasting are indispensable tools for organizations that navigate uncertainties and make informed decisions. by leveraging these techniques, businesses can anticipate future financial conditions, allocate resources efficiently, and align strategies with market realities.

Financial Forecasting And Modeling - Espresso Tutorials

Financial Forecasting And Modeling - Espresso Tutorials Financial forecasting vs. financial modeling: the hidden differences experts want you to know the covid 19 pandemic forced businesses worldwide to rebuild their financial forecasting models from scratch. the economic upheaval revealed something significant: knowing the difference between financial forecasting and financial modeling could determine a company’s survival through smart decisions. Financial forecasting and modeling are the backbone of business decision making. the correct forecast can be the difference between making a strategic leap forward and tumbling into deep operational pitfalls. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results. a financial model is simply a spreadsheet, usually built in microsoft excel, that forecasts a business’s financial performance into the future. Financial modeling and forecasting are indispensable tools for organizations that navigate uncertainties and make informed decisions. by leveraging these techniques, businesses can anticipate future financial conditions, allocate resources efficiently, and align strategies with market realities.

Financial Modeling And Forecasting Financial Statements Online Class | LinkedIn Learning ...

Financial Modeling And Forecasting Financial Statements Online Class | LinkedIn Learning ... The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results. a financial model is simply a spreadsheet, usually built in microsoft excel, that forecasts a business’s financial performance into the future. Financial modeling and forecasting are indispensable tools for organizations that navigate uncertainties and make informed decisions. by leveraging these techniques, businesses can anticipate future financial conditions, allocate resources efficiently, and align strategies with market realities.

Financial Modeling And Forecasting - Shadow Director

Financial Modeling And Forecasting - Shadow Director

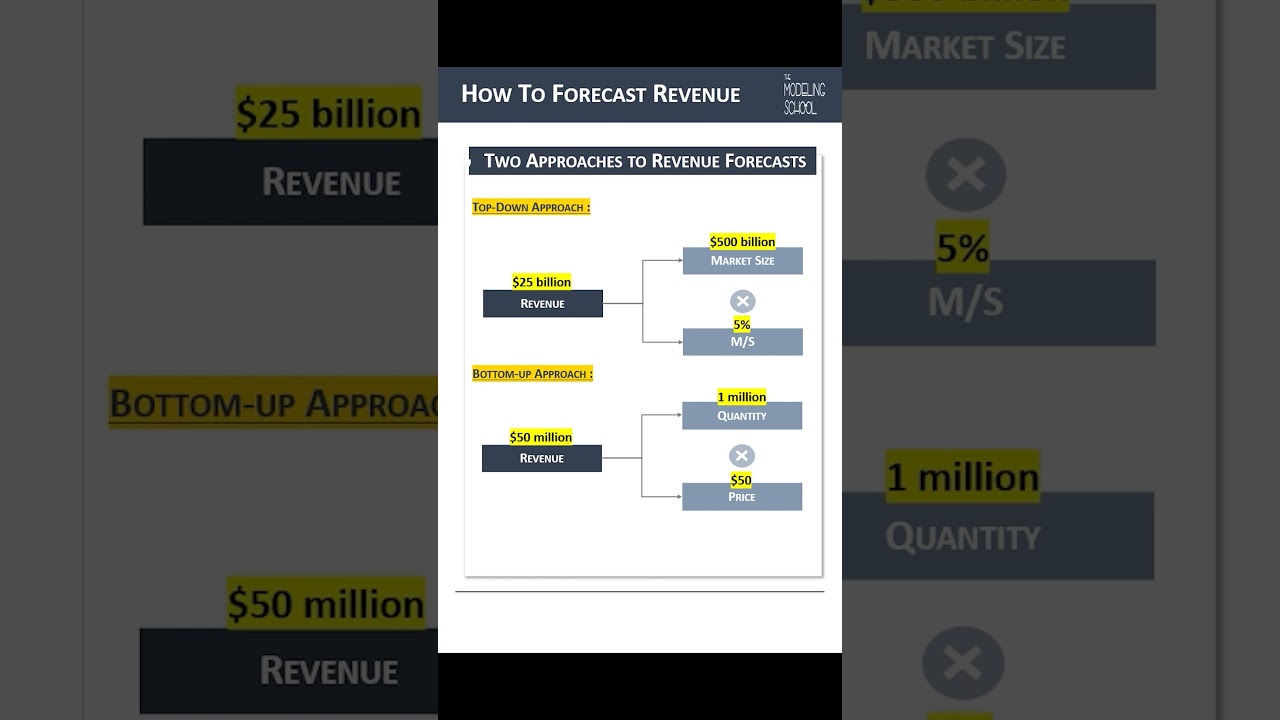

Top-Down vs. Bottom-Up: Two Key Approaches to Forecasting Revenue 📈

Top-Down vs. Bottom-Up: Two Key Approaches to Forecasting Revenue 📈

Related image with financial modeling versus forecasting whats the difference now cfo

Related image with financial modeling versus forecasting whats the difference now cfo

About "Financial Modeling Versus Forecasting Whats The Difference Now Cfo"

Comments are closed.