Asset Class Scoreboard November 2022 Rcm Alternatives

Asset Class Scoreboard: November 2022 - RCM Alternatives

Asset Class Scoreboard: November 2022 - RCM Alternatives The quintile rankings and rcm star rankings shown here are provided for informational purposes only. rcm does not guarantee the accuracy, timeliness or completeness of this information. Rcm receives a portion of the commodity brokerage commissions you pay in connection with your futures trading and/or a portion of the interest income (if any) earned on an account’s assets.

Asset Class Scoreboard: November 2022 - RCM Alternatives

Asset Class Scoreboard: November 2022 - RCM Alternatives Whoa. the international equity markets have finally shown up to the party, taking a giant leap in november for its biggest gain in quite some time. the rest of the scoreboard looked pretty. Forex trading, commodity trading, managed futures, and other alternative investments are complex and carry a risk of substantial losses. as such, they are not suitable for all investors. The november asset class scoreboard paints a nuanced picture of the investment landscape in the wake of the recent election. concerns about potential political instability or market volatility proved unfounded, as the democratic process unfolded with integrity, allaying previous anxieties. This slight shift in results in july highlights the need for a balanced, well diversified portfolio that can withstand the ebb and flow of different asset class trends.

Asset Class Scoreboard: October 2022 - RCM Alternatives

Asset Class Scoreboard: October 2022 - RCM Alternatives The november asset class scoreboard paints a nuanced picture of the investment landscape in the wake of the recent election. concerns about potential political instability or market volatility proved unfounded, as the democratic process unfolded with integrity, allaying previous anxieties. This slight shift in results in july highlights the need for a balanced, well diversified portfolio that can withstand the ebb and flow of different asset class trends. 📊 january market insights: strong start to 2024 all major asset classes kicked off the year in positive territory, with global stocks and commodities leading the surge. As the final whistle blew on december 2024, the asset class scoreboard showed a tough month for most players, with only a few bright spots. managed futures showed some resilience, posting a solid gain of 1.27% in december, although that was mainly a bounce back from a down month in november. All etf performance data from y charts. the performance data displayed herein is compiled from various sources, including barclayhedge, and reports directly from the advisors. Year to date, most asset classes are in positive territory, with u.s. stocks leading the way at 11.30%. commodities have also posted substantial gains of 9.42% in aggregate, while international shares are up 6.10%.

Asset Class Scoreboard: March 2022 - RCM Alternatives

Asset Class Scoreboard: March 2022 - RCM Alternatives 📊 january market insights: strong start to 2024 all major asset classes kicked off the year in positive territory, with global stocks and commodities leading the surge. As the final whistle blew on december 2024, the asset class scoreboard showed a tough month for most players, with only a few bright spots. managed futures showed some resilience, posting a solid gain of 1.27% in december, although that was mainly a bounce back from a down month in november. All etf performance data from y charts. the performance data displayed herein is compiled from various sources, including barclayhedge, and reports directly from the advisors. Year to date, most asset classes are in positive territory, with u.s. stocks leading the way at 11.30%. commodities have also posted substantial gains of 9.42% in aggregate, while international shares are up 6.10%.

Asset Class Scoreboard: March 2022 - RCM Alternatives

Asset Class Scoreboard: March 2022 - RCM Alternatives All etf performance data from y charts. the performance data displayed herein is compiled from various sources, including barclayhedge, and reports directly from the advisors. Year to date, most asset classes are in positive territory, with u.s. stocks leading the way at 11.30%. commodities have also posted substantial gains of 9.42% in aggregate, while international shares are up 6.10%.

Asset Class Scoreboard: May 2022 - RCM Alternatives

Asset Class Scoreboard: May 2022 - RCM Alternatives

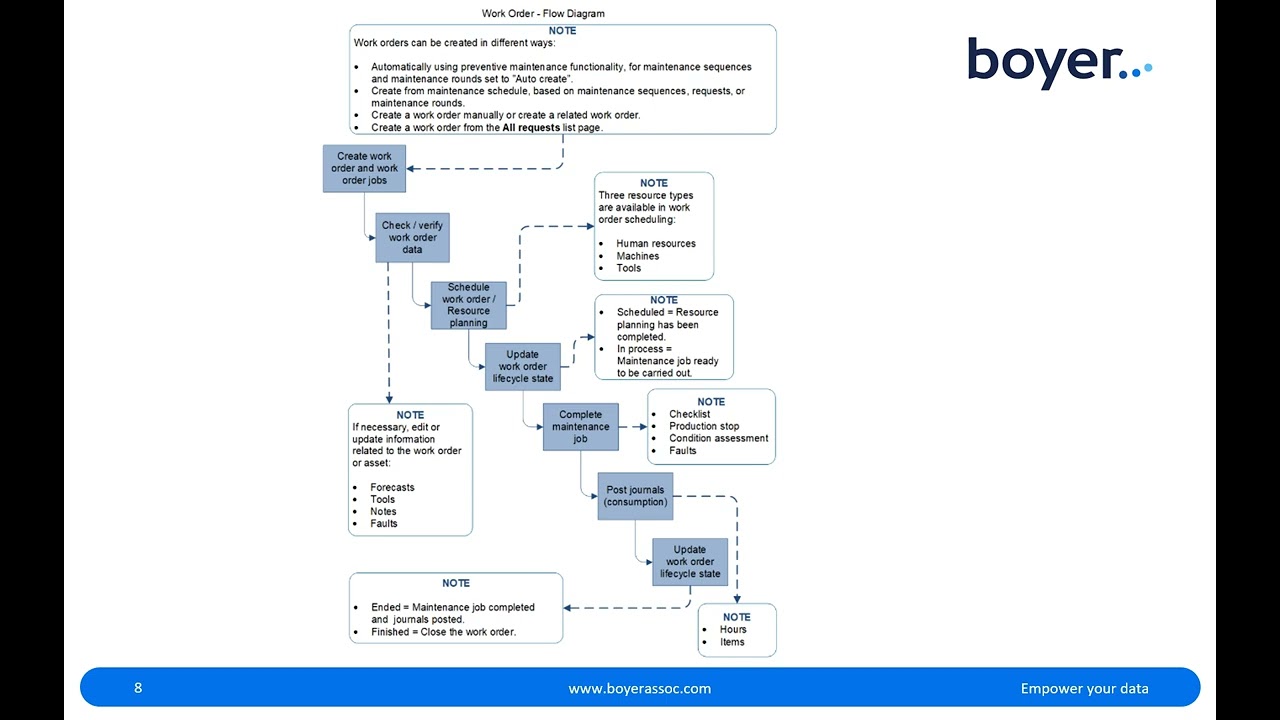

Asset Management in FSCM

Asset Management in FSCM

Related image with asset class scoreboard november 2022 rcm alternatives

Related image with asset class scoreboard november 2022 rcm alternatives

About "Asset Class Scoreboard November 2022 Rcm Alternatives"

Comments are closed.